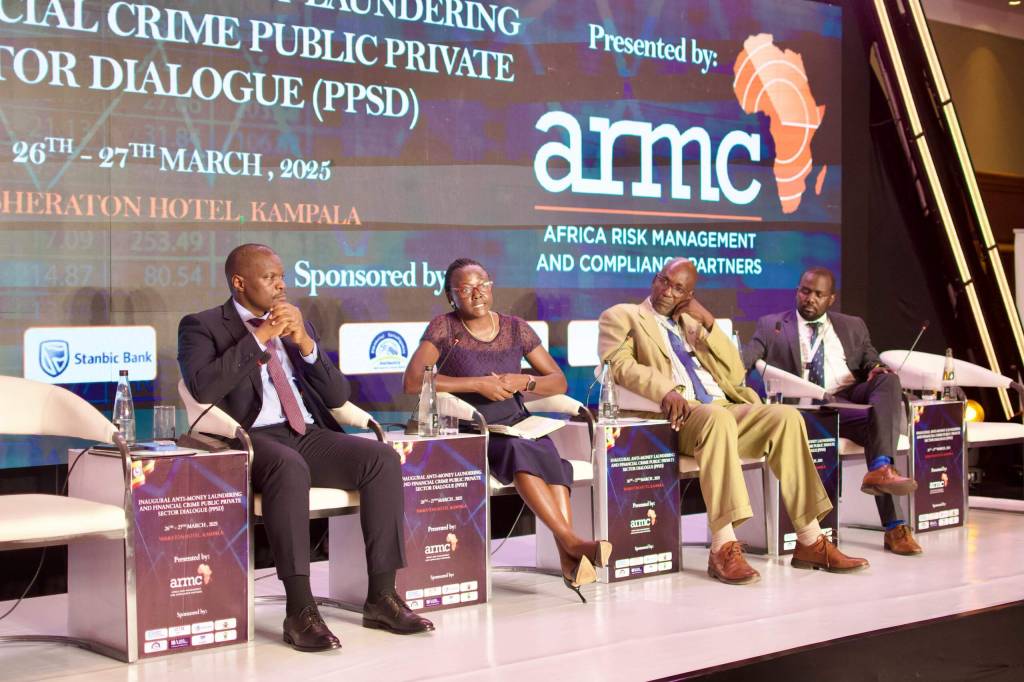

Home Trending News Trending Stories Uganda’s Exclusion from the FATF Grey List Marks a Major Step in Anti-Money Laundering Reforms

Uganda’s Exclusion from the FATF Grey List Marks a Major Step in Anti-Money Laundering Reforms

Ugandans Should Not Have to Choose Between Surgery and Poverty

For too long, the story of surgery in Uganda has carried an unavoidable fear: the fear tha…