UGX 1.5 Trillion Locked in Tax Appeals

A total of UGX 1.5 trillion is tied up in tax disputes, with the Office of the Auditor General (OAG) describing the handling of cases by the Tax Appeals Tribunal (TAT) as “very slow,” limiting the circulation of funds needed to sustain private sector activities.

The TAT, a quasi-judicial body established under the Tax Appeals Tribunal Act, 1997, resolves tax disputes between taxpayers and the Uganda Revenue Authority. Section 20(3) of the Tax Appeals Tribunal Act provides that decisions on review applications should be made as soon as practicable after hearings and communicated to all parties.

The 2025 Auditor General’s report notes that the tribunal faces a rapidly growing backlog of high-value cases due to weak case disposal capacity, prolonged delays, and limited public awareness of its mandate.

On average, disputes take 10 months to resolve. The number of pending cases has risen from 169 in 2022/23 to 476 in 2024/25. Two cases have been unresolved for more than 50 months, valued at UGX 6.46 billion and UGX 10.3 billion, while another 27 cases worth UGX 33 billion have been pending for 30-40 months.

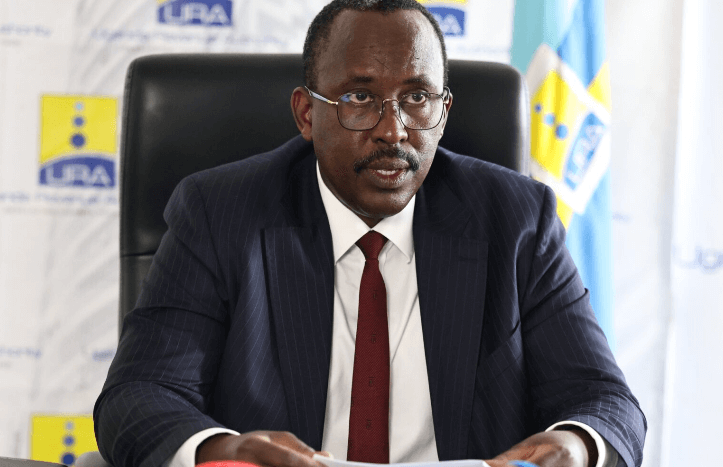

Cases unresolved for 20-30 months total 30 and are valued at UGX 201.6 billion; those pending 10-20 months are 119 and worth UGX 442.5 billion. Auditor General Edward Akol said the growing backlog is partly due to insufficient funding.

“Despite the increase in TAT membership from five to nine members in 2022, the budget has remained static at UGX 7.7 billion, which is inadequate to support the tribunal’s increasing workload,” he said.

Akol advised the tribunal to liaise with relevant stakeholders to strengthen its capacity for disposing of tax appeals. Despite these challenges, the tribunal reported progress in the six months ending December 31, 2025.

Tribunal Chairperson Crystal Kabajwara said: “We began this year with a clear strategy and outcomes we are confident we will achieve by the end of the financial year 2026 – growing the number and value of cases disposed of by 30 percent, reducing the average case age from 11 to 9 months, and cutting the backlog.”

By December 2025, the tribunal had resolved 146 cases, unlocking UGX 203 billion into the economy. Kabajwara noted that performance exceeded the previous half-year: 57 percent more disputes resolved and 182 percent more funds unlocked.

NRM’s Mugenyi Petitions Court to Nulify Hoima City Woman MP Results

Youth Summer Camp Inspires Young Minds at St. Augustine International School

Free RR Bukedea Eye Camp

NRM’s Mugenyi Petitions Court to Nulify Hoima City Woman MP Results

Free RR Bukedea Eye Camp

Uganda Airlines Wet-Leases Ethiopian Airline’s Boeing 787-8

Court Fixes Agasiirwe Bail Application for Ruling

NRM’s Mugenyi Petitions Court to Nulify Hoima City Woman MP Results

Princess Dianah Rouse Jane Mugenyi Abwooli has petitioned the High Court in Hoima to nulli…

Now On Air – 88.2 Sanyu Fm

Get Hooked Right Here

DON'T MISS!!!

NRM’s Mugenyi Petitions Court to Nulify Hoima City Woman MP Results

Princess Dianah Rouse Jane Mugenyi Abwooli has petitioned the High Court in Hoima to nullify the election of Hoima City Woman Member of Parliament Nyakato Asinansi,