Parliament Defers UGX 759Bn Water Loan Approval over Lack of Quorum

A motion to authorise the government to borrow €183.390 (about 759 billion Shillings) from Standard Chartered Bank and 120.395 billion from the domestic market through a six-month Treasury Bill hit a snag in Parliament due to a lack of quorum.

The funds, intended to finance Phase II of the Strategic Towns Water Supply and Sanitation Project (STWSSP II), aim to improve water and sanitation services in key Ugandan towns.

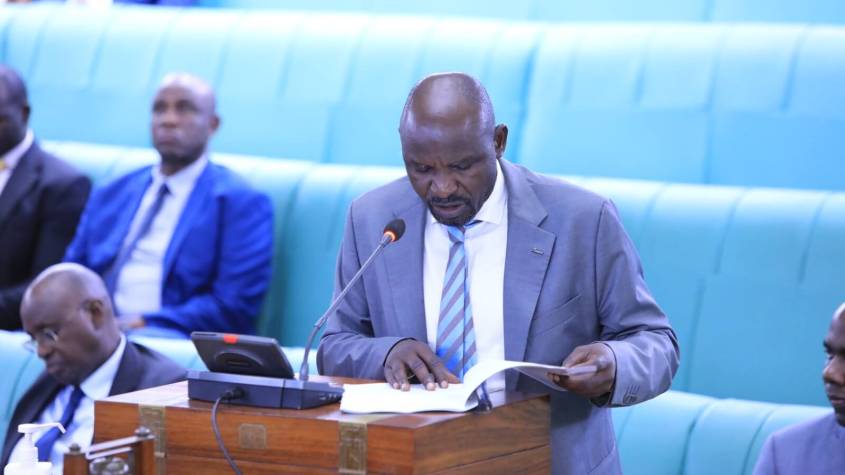

The motion, tabled by Henry Musasizi, Minister of State for Finance, Planning, and Economic Development (General Duties), was presented under Article 159 of the Constitution, Section 34 of the Public Finance Management Act (as amended), and Rule 162 of Parliament’s Rules of Procedure.

Musasizi emphasised the project’s alignment with the government’s goal of ensuring sustainable access to safe water, hygiene, and sanitation for urban populations by 2030. “This project will enhance water supply and sanitation infrastructure, improve service quality, and strengthen system management in targeted towns,” Musasizi told Parliament.

The initiative focuses on four clusters: Nakasongola, Kasambira in Kamuli, Bugadde in Mayuge, Idudi-Buseesa in Bugweri, and Alebtong in Alebtong District. It includes three key components: urban water supply infrastructure, sanitation infrastructure development, and project management.

The project, costing €221.682 million, will be financed through a €183.309 million loan from Standard Chartered Bank, UGX 120.395 billion (€29.572 million) in domestic borrowing, and €8.8 million in government counterpart funding over five years. The counterpart funds will cover recurrent costs, land acquisition, coordination, and monitoring, with allocations starting in FY 2025/26.

Musasizi noted that the right-of-way acquisition for the project is 75% complete, with phase one finalised in Nakasongola, Kamuli, Kasambira, Alebtong, Budadde-Mayuge, and Idudi-Buseesa, in collaboration with local government leaders.

The loan terms include a 14-year tenure with a four-year grace period, an interest rate of six-month EURIBOR plus a 2.10% margin, a 0.63% annual commitment fee, a 1.4% upfront arrangement fee, a $20,000 annual agency fee, and a 2% default fee. The six-month Treasury Bill will cover 15% of the loan’s contract sum.

The project is expected to provide safe water and sanitation to 740,000 people by 2030 and over 1 million by 2050, serving 51 towns across 115 parishes. It will also support industrial areas, including a cassava processing plant in Nakasongola and a proposed industrial park in Kakoge. Additional benefits include training 150 individuals in urban sanitation skills and reducing the burden on women and children fetching water from distant, unsafe sources.

However, the proposal faced scrutiny in Parliament. John Bosco Ikojo, Chairperson of the National Economy Committee, presented a report highlighting Uganda’s public debt, which stood at $25.55 billion (UGX 93.6 trillion, 46.86% of GDP) as of June 2024, down slightly from 47.4% the previous year.

The committee noted that Uganda’s debt remains sustainable, with a medium debt-carrying capacity (composite indicator score of 2.93). It recommended swift fulfilment of financing conditions to ensure timely fund disbursement but urged the government to explore alternative creditors and renegotiate terms to align with the 2023 Public Debt Management Framework.

A minority report by Hassan Kirumira (Katikamu South) and Charles Tebandeke (Bbale County) opposed the loan, citing high costs and procedural concerns. They urged Parliament to reject or defer approval until more favourable terms are secured, emphasising fiscal prudence in a high-debt environment.

Milton Kalulu Muwuma (Kigulu County South) expressed confusion over the committee’s report, which raised concerns but ultimately recommended approval.

Jonathan Odur (Erute County South) argued that approving the loan without addressing the committee’s concerns could lead to a resolution misaligned with Parliament’s intent, urging a review before approval.

Leader of Opposition Joel Ssenyonyi highlighted Uganda’s growing debt burden, referencing 16.4 trillion Shillings in undisbursed loans and 70 billion Shillings in commitment fees paid as of December 2024, per the Auditor General’s report. He questioned the shift from the African Development Bank, the previous creditor for Phase I, and demanded clarity on alternative financing options.

Ssenyonyi also raised procedural issues, noting that neither the majority nor minority reports met the required one-third committee member signatures (19 out of 56), with the majority report having 16 and the minority only two.

Deputy Speaker Thomas Tayebwa clarified that 19 members had signed the majority report, but Ssenyonyi contested the discrepancy in the distributed copies. He further cited Rule 25, which requires a quorum of 177 MPs (one-third of voting members) to decide on such matters.

With insufficient physical and online attendance, Tayebwa adjourned the session leaving the loan’s approval in limbo.

The stalled motion underscores tensions between Uganda’s development needs and concerns over fiscal sustainability, with MPs calling for greater transparency and accountability in the country’s borrowing practices.

Woman Commits Suicide Over Debts of UGX 6million

Constitutional Court Dismisses Petition Against NRM-DP Cooperation Deal

Woman Commits Suicide Over Debts of UGX 6million

Constitutional Court Dismisses Petition Against NRM-DP Cooperation Deal

Woman Commits Suicide Over Debts of UGX 6million

Gulu Central Police is investigating the circumstances under which a 52-year-old businessw…

Now On Air – 88.2 Sanyu Fm

Get Hooked Right Here

DON'T MISS!!!

Woman Commits Suicide Over Debts of UGX 6million

Gulu Central Police is investigating the circumstances under which a 52-year-old businesswoman in Gulu City, Claire Nambooze, took her own life in her house in Vanguard Cell, Laroo Pece Division, Gulu city.