Financial Sector Security Lapses Blamed on Absence of Bank Governor

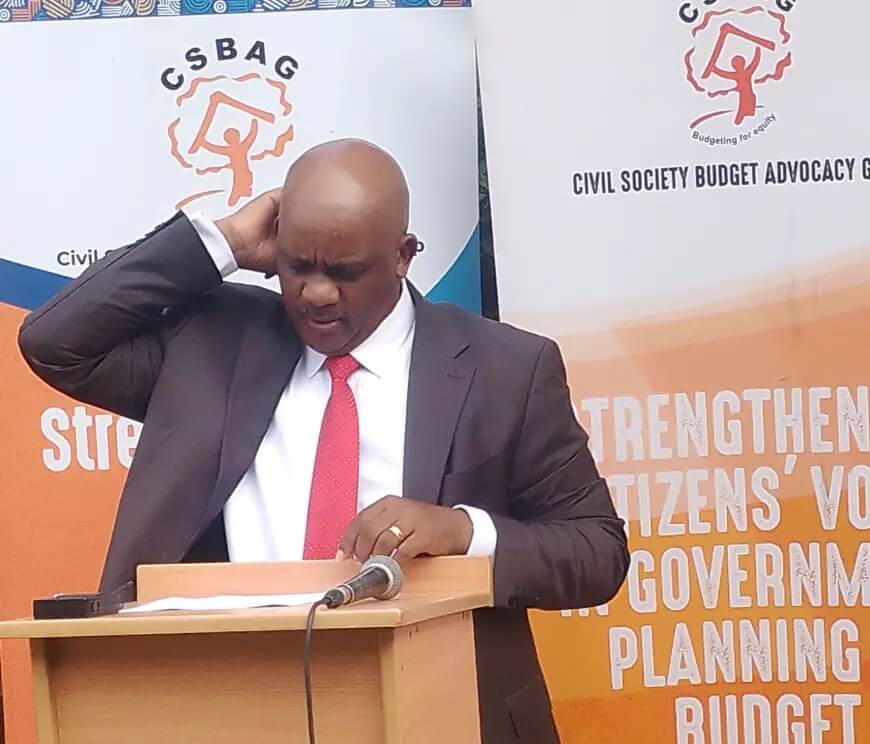

The Executive Director of the Civil Society Budget Advocacy Group (CSBAG) says the growing threats and increasing vulnerabilities in the financial sector is as a result of government’s failure to appoint the central bank governor for the last three years.

Julius Mukunda was giving an end of year press briefing at CSBAG headquarters in Ntinda.

He said that the central bank plays a critical role in overseeing and regulating financial institutions,ensuring their stability and public’s trust in the financial system and without the governor there is a significant leadership void that hampers effective oversight, governance and response to emerging financial threats.

He cites threats such as rising incidences of cybercrime and operational lapses in the banking sector.

Mukunda says that such threats highlight the critical need for a competent and active central bank governor to restore oversight, enforce regulatory measures and improver cyber security within Uganda’s financial sector.

His comments follow the emergence of a scandalous theft from the Central Bank a few weeks ago where when unknown fraudsters were able to access close to 14 million dollars from the treasury and transfer the funds to private accounts abroad.

The deputy governor of the Bank of Uganda Michael Atingi-Ego has since come out to claim that the central Bank’s IT systems were not compromised by the fraudsters and that the bank merely received instructions to pay funds into the said accounts.

A conclusive investigative report on the heist is yet to be produced by the investigative arms of government security agencies.

Commenting on the capping of money lender rates, the Executive Director described it as a commendable move by the government, but noted it addresses only a symptom of a deeper, more complex issue.

Mukanda mentioned that the real problem lies in the fundamental drivers of the demand for expensive credit, even when reasonably priced alternatives are available through commercial banks.

“The high demand for costly loans is largely driven by the government’s consistent borrowing from the domestic market, which has crowded out private sector credit growth. By September 2024, cumulative credit to the government had reached 22 trillion UGX, compared to just 24 trillion UGX extended to the private sector.”

This large-scale borrowing by the government not only raises the cost of credit for businesses and individuals but also limits the availability of funds for the private sector, which is forced to pay higher rates as a result, said Mukanda.

“The government should therefore support initiatives to avail risk-related information on sectors and borrowers in the economy to enable transparent pricing of credit. It should on priority popularize the financial consumer protection guidelines 2019 and related regulatory frameworks that protect the consumers of financial products and services.” he added.

Court Blocks Kamuli Municipality MP Vote Recount

President Museveni Hosts AU–EAC–SADC Panel on DRC Peace Process

Mabirizi Remanded for Abusing Justice Ssekaana Again

Nandala Demands EC Resignation

Activists Accuse Police of Becoming Regime Protection Force

State House Unit Swoops in to Arrest Parliamentary Candidate after Nomination

Pharmacists are not Doctors – Medical Association Condemns EOC Ruling

NEED Party Suspends Founding President Kabuleta

Activists Accuse Police of Becoming Regime Protection Force

The Center for Constitutional Governance (CCG) has condemned the continuous illegal arrest…

Now On Air – 88.2 Sanyu Fm

Get Hooked Right Here

DON'T MISS!!!

Court Blocks Kamuli Municipality MP Vote Recount

The decision follows an application by the Kamuli Municipality Member of Parliament-elect, Mastula Namatovu, asking the high court to halt the vote recount that had earlier been ordered by the Kamuli Chief Magistrate’s Court.